Partnership and multi-member LLCs tax returns/ extension deadlines. For fiscal year corporations Form 7004 should be filed by the 15 th day of the fourth month after the corporation’s fiscal year. This means, with the six-month extension, your new due date is October 15. Corporate tax return/extension deadlinesĬorporations who use IRS Form 1120 to file annual federal taxes with a calendar year-end date of December 31 should file Form 7004 on or before the corporate tax deadline. Read on to see what applies to your situation: The Form 7004 deadline depends on your small business structure. This form is only one page and doesn’t require your signature. What calendar year you’re applying an extension for. Additional information about your business. Part II: (All Filers Must Complete This Part.) It includes: Part I: Automatic Extension for Certain Business Income Tax, Information, and Other Returns (Enter the form code, based on the type of business tax return you’re filing.) Identifying number (Employer Identification Number or Social Security number). Here are the general Form 7004 instructions, so you can get a gauge on what information is needed:Īt the top of Form 7004, print or type your:

Partnership and multi-member LLCs tax returns/ extension deadlines. For fiscal year corporations Form 7004 should be filed by the 15 th day of the fourth month after the corporation’s fiscal year. This means, with the six-month extension, your new due date is October 15. Corporate tax return/extension deadlinesĬorporations who use IRS Form 1120 to file annual federal taxes with a calendar year-end date of December 31 should file Form 7004 on or before the corporate tax deadline. Read on to see what applies to your situation: The Form 7004 deadline depends on your small business structure. This form is only one page and doesn’t require your signature. What calendar year you’re applying an extension for. Additional information about your business. Part II: (All Filers Must Complete This Part.) It includes: Part I: Automatic Extension for Certain Business Income Tax, Information, and Other Returns (Enter the form code, based on the type of business tax return you’re filing.) Identifying number (Employer Identification Number or Social Security number). Here are the general Form 7004 instructions, so you can get a gauge on what information is needed:Īt the top of Form 7004, print or type your:

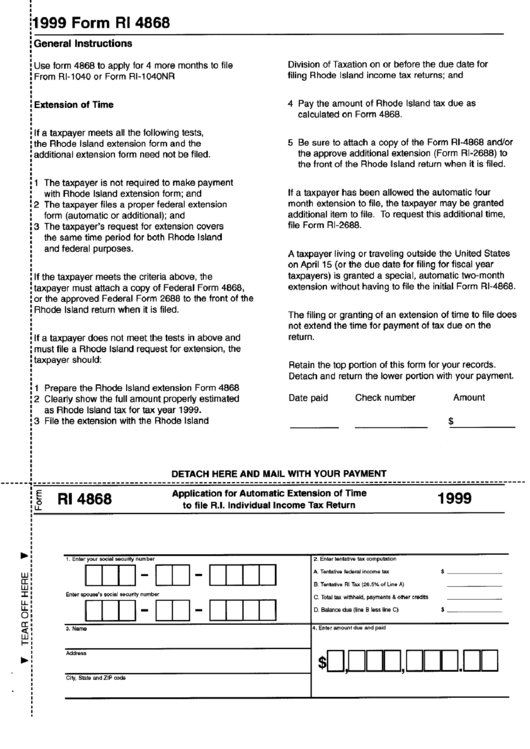

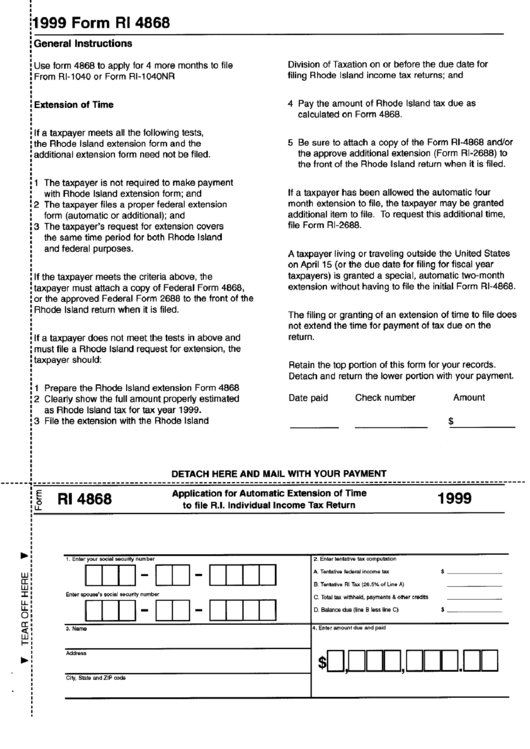

Thankfully, this is a fairly short form, which only requires a handful of key details.

Plus, we’ll help you get your business tax return across the finish line. You can also download and print an interactive version of the form on the IRS website and paper file it.ĭon’t want to file an extension by yourself? A Block Advisors certified small business tax pro is ready to help you file your extension. Multiple-member LLCs filing as partnerships.

0 kommentar(er)

0 kommentar(er)